Laser Digital CEO on APAC’s Crypto Shift

Originally posted 12th September 2025, BeInCrypto

- APAC institutions still weigh reputational risk, compliance, and security, but are cautiously advancing through pilots and partnerships.

- Treasury pioneers like Metaplanet and Remixpoint test early strategies that could inspire wider adoption or reinforce caution across markets.

- Tokenization pilots, stablecoin regulation, and Web3 adoption show APAC is preparing to shape the next phase of global crypto growth.

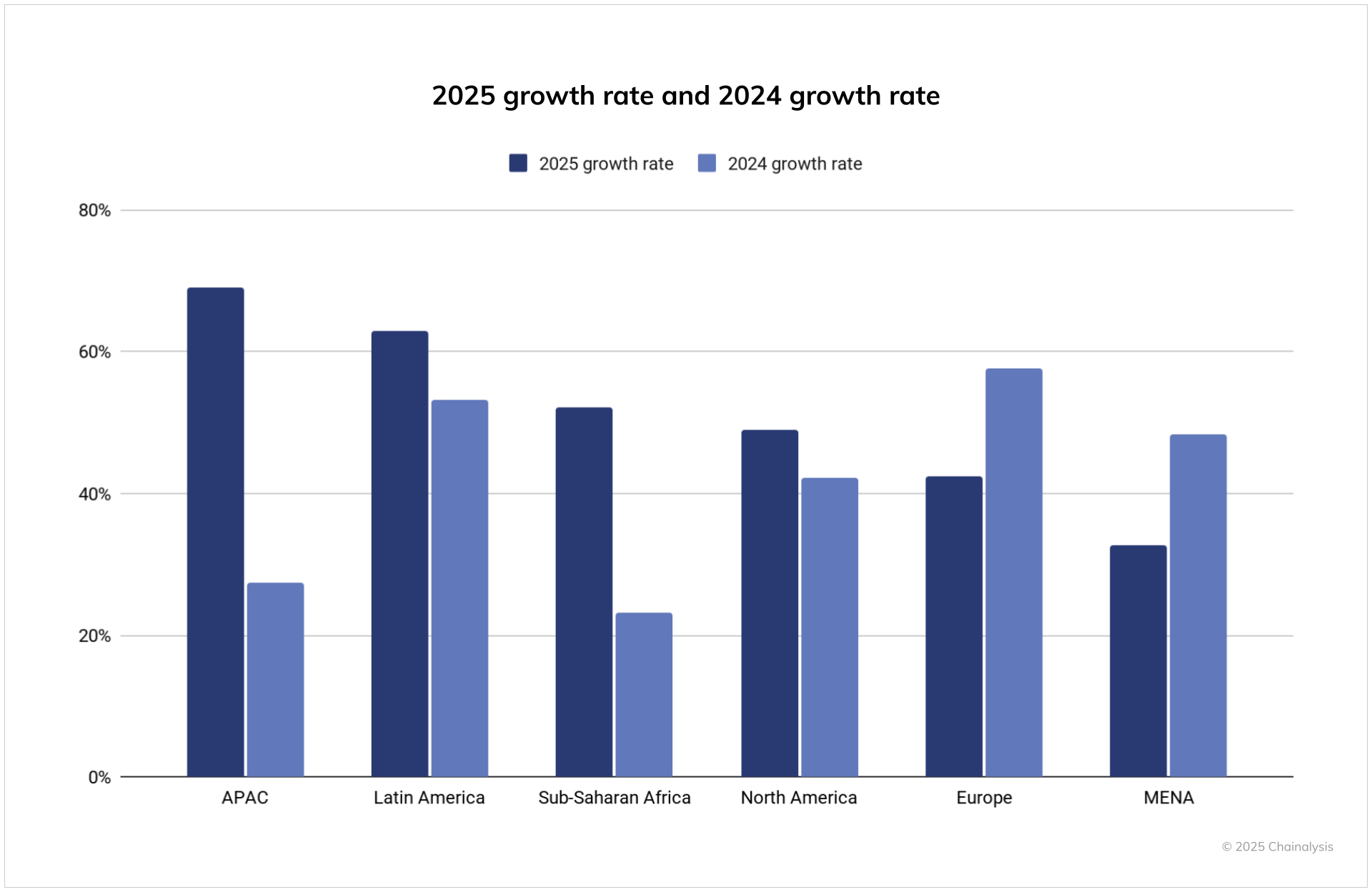

Institutional adoption of digital assets is accelerating across the Asia-Pacific. The Chainalysis 2025 Global Crypto Adoption Index shows APAC leading global growth, with value received rising 69% year over year to $2.36 trillion. India tops the index, while Japan, Korea, and Southeast Asia expand pilots and sandboxes.

Against this backdrop, BeInCrypto spoke with Dr. Jez Mohideen, Co-Founder and CEO of Laser Digital, Nomura Group’s digital asset arm, to discuss where Web3 adoption is most active.

Institutional Investors’ Real Concerns

Despite rising grassroots adoption, many boardrooms still judge it “too early.” If so, what do the institutions cite in internal discussions when weighing crypto adoption? Mohideen’s response highlighted the reputational, security, and compliance hurdles that dominate the agenda.

“Across APAC, institutional interest in digital assets continues to grow. However, adoption is approached with caution, possibly due to lingering concerns around reputational risk, cybersecurity threats (e.g., financial losses from hacking incidents), and compliance with global standards such as Basel III, FATF, AML, and CFT frameworks.”

These concerns remain urgent. BeInCrypto reported that alleged North Korean hackers stole $1.6 billion in the first half of 2025, including $1.5 billion from Bybit alone. Such losses explain why institutions demand custody, insurance, and audit clarity before moving forward.

Industry Response Levels

Which industries in APAC are leading the charge? Banks and securities firms have announced pilots, while insurers remain cautious. Mohideen said the gap reflects not just regulation but also internal strategy.

“While it’s difficult to generalize by industry, responses vary significantly by individual firm strategy. Insurance companies tend to be more conservative and slower to engage with digital assets. Other sectors, including banking and securities firms, tend to show more proactive exploration, often through pilot programs or strategic partnerships.”

Four-Year Cycle and Market Outlook

Bitcoin has long been framed by its halving-driven four-year cycle. But in 2024, the cycle broke precedent: Bitcoin surged to a new all-time high before the halving, driven by institutional accumulation rather than retail speculation.

Analysts say this shift reflects Bitcoin’s evolution into a macro asset tied to global liquidity, reducing the halving’s role as a decisive signal. Do the institutions still pay attention to the cycle?

“Institutional investors typically view Bitcoin’s halving cycle as one of many market indicators. Broader regulatory developments and structural demand shifts are increasingly influential. The halving may contribute to sentiment, but it is not a decisive factor in institutional decision-making.”

These remarks align with the changing structure of flows. Farside Investors data shows US spot bitcoin ETFs pulled $54.5 billion since January 2024, while Bloomberg noted billions in ether ETF inflows in 2025. Together, Bitcoin and Ethereum now anchor institutional benchmarks alongside macro indicators.

Bitcoin Treasury Strategies and Early Examples

Treasury adoption has been touted as a sign of institutional conviction, with firms like Metaplanet and Remixpoint in Japan adding bitcoin. Yet cracks are visible. BeInCrypto reported that many listed treasury firms now trade below their mNAV, limiting their ability to raise funds and exposing them to forced sales. Some analysts call the strategy “the greatest financial arbitrage in history,” while others warn it resembles a Ponzi-like bet. How early did the adopters begin shaping the discussion?

“In Japan, regulatory discussions around crypto taxation and accounting are advancing. Some firms have adopted crypto treasury strategies, which are being closely watched. These early adopters serve as practical case studies in risk management. Their success or failure may influence broader institutional behavior, but adoption will ultimately depend on regulatory clarity and operational readiness.”

Beyond Japan, Hong Kong’s Yunfeng Financial allocated $44 million in ETH, while China Renaissance committed $200 million to Web3, including $100 million in BNB, earning the “BNB MicroStrategy” moniker. These firms remain case studies in how treasuries adapt amid market stress.

Tokenization and Liquidity Integration

Tokenization is accelerating globally. Singapore’s Project Guardian has expanded into bonds and FX, Hong Kong issued multi-currency digital bonds, and Japan continues refining STO frameworks. How can these developments converge with crypto liquidity? Who will take the lead?

“Tokenization of traditional assets (equities, bonds) is progressing, but integration with crypto market liquidity remains complex. Regulatory constraints on public chain issuance may delay convergence. Banks and exchanges bring trust and scale, but the real opportunity lies in collaboration with new infrastructure players who can bridge regulated markets with public chain innovation. Together, this convergence could reshape capital markets into something far more global, liquid, and accessible.”

Stablecoin Proliferation and Interoperability

Stablecoin frameworks are proliferating across APAC. Japan classified JPYC as an electronic payment instrument, Hong Kong’s ordinance set HK$25 million capital requirements, and South Korea floated a state-backed blockchain. Can interoperability be achieved amid diverging rules?

“The emergence of such stablecoins may add to the overall dynamics, but it’s likely that any form of competition will arise from business factors rather than political factors. Competition will likely emerge based on overall convenience, UX, and actual costs to use them (i.e. implementation costs). Both regulators and issuers are entering uncharted territory, and given the critical importance of settlement functions, the launch and expansion will likely proceed cautiously.

Global connection and interoperability are expected features from the outset. Each jurisdiction wants control, each issuer wants stickiness. That creates the risk of siloed liquidity. Initial operations are likely to be conducted with limited functionality and reduced versatility.”

APAC Market Reality

While Hong Kong and Singapore lead public messaging, Mohideen said activity is spreading more widely. Where is it that capital, talent, and Web3 adoption—DeFi, DEXs, NFTs—are truly active?

“While Hong Kong and Singapore are publicly prominent, real activity is also emerging in Japan, Korea, and Southeast Asia. Sandbox initiatives and pilot programs are gaining traction. In Japan, interest in DeFi and DEXs is growing among crypto-native users. While broader adoption will appear gradually, it shouldn’t be seen as a slow start. What we are seeing is more of a focused approach that will enable the ecosystem to grow faster once the foundation is in place.”

The family office trend illustrates this. UBS and Reuters noted that Asian wealthy families now allocate 3%–5% to crypto, treating it as an essential part of their portfolio. Combined with grassroots adoption, these flows show that Web3 is no longer in the APAC niche.

Risk Landscape

Our final question was on how institutions balance opportunity with risk. Mohideen’s earlier points on security and governance resonate as regulators act against laundering tools and leveraged treasury models face strain.

The DOJ’s conviction of Tornado Cash co-founder Roman Storm underscored enforcement priorities. Analysts warn that debt-heavy treasuries face a $12.8 billion maturity wall by 2028. APAC institutions are responding with equity-funded, transparency-first approaches, as BeInCrypto reported on treasury adoption.

Mohideen’s perspective highlights both caution and momentum in APAC. Institutions still weigh risks, yet tokenization pilots, stablecoin rules, and treasury experiments point to fast-maturing markets. With Bitcoin and Ethereum as benchmarks and Web3 adoption spreading, APAC lays the groundwork to shape the next phase of global digital finance.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that BeInCrypto’s Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Nature of this document: The information in this presentation (the “Presentation”) have been prepared for informational and educational purposes only. This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This document is not a contractually binding document or an information document required by any legislative provision, and is not sufficient to take an investment decision. This document is a confidential communication to and solely for the use of, the people to whom it is directly distributed. No recipient of this document may distribute this report or otherwise disclose its contents, unless required by applicable laws.

Addressees: This document is addressed exclusively to professional and institutional investors (i.e. eligible counterparties) residing in eligible jurisdictions. This document does not take into account any internal policies and procedures, regulatory restrictions nor investor’s particular objectives, financial situation or suitability and/or appropriateness. Any recipient hereof should conduct its own independent analysis and the data contained or referred to herein or therein. None of the products/services offered by Laser Digital are available to retail investors in any jurisdiction.

No distribution: This Presentation is strictly confidential and intended only for professional investors or other investors to whom this Presentation can be lawfully communicated. It is for information purposes only and is subject to change. The distribution of this Presentation and other information contained in it may be restricted by law in certain jurisdictions and persons into whose possession any document or other information referred to in this Presentation comes should inform themselves about and observe any such restriction. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. This material may only be availed of by the customer to whom it was distributed. This material is the copyrighted work of Laser Digital and you may not copy, transmit or redistribute this material, in whole or in part, without the prior written consent of Laser Digital.

No offering: Nothing in this Presentation amounts to, or should be construed as, an offer, placement, invitation or general solicitation to invest in any fund or to buy or sell securities, digital assets, or to engage in any other related or unrelated transactions. This document does not purport to contain all of the information that may be required to evaluate any potential transaction and should not be relied on in connection with any such potential transaction. Any future offers to invest in the fund/other products will be subject to the terms of the relevant offering documentation.

Non-reliance: The Presentation is not a recommendation and should not be relied upon as accounting, legal, tax or investment advice. You should consult your tax, legal, accounting or other advisers separately. Neither this Presentation nor the information contained in it is for publication or distribution, directly or indirectly, in or into any jurisdiction where to do so might constitute a violation of applicable law. None of Nomura, Laser Digital, their group companies or any of their respective directors, officers, employees, partners, shareholders, advisers, agents or affiliates (together the “Sponsor Parties”) make any representation or warranty, express or implied, as to the accuracy or completeness of the information contained in this Presentation, and nothing contained in it shall be relied upon as a promise or representation whether as to past or future performance. To the maximum extent permitted by law, none of the Sponsor Parties shall be liable (including in negligence) for direct, indirect or consequential losses, damages, costs or expenses arising out of or in connection with the use of or reliance on this Presentation. The information contained in this document is unaudited. It is published for the assistance of recipients, but is not to be relied upon as authoritative and is not to be substituted for the exercise of one’s own judgment. The given material is subject to change and, although based upon information which Laser Digital considers reliable, it is not guaranteed as to accuracy or completeness and there is a possibility that such information was summarized and imperfect. Any data contained in this is subject to verification or amendment. Recipients of this document should seek their own professional advice, as appropriate, before providing services and/or buying, selling or investing in any financial instruments or digital assets. No liability whatsoever shall be accepted for any loss, damage, cost or expense arising from any use of this presentation or its contents. This information may not be current and Laser Digital has no obligation to provide any updates or changes.

Digital Assets: Digital assets regulation is still developing across all jurisdictions and governments may in the future restrict the use and exchange of any or all digital assets. Digital assets are generally not backed nor supported by any government or central bank, are not insured by depositor nor investor guarantees schemes and do not have the same protections countries’ bank deposits may have and are more volatile than traditional currencies and/or other investments. Transacting in digital assets carries the risk of market manipulation and cybersecurity failures such as the risk of hacking, theft, programming bugs, and accidental loss. Differing forms of digital assets may carry different risks. In certain circumstances it may not be possible to liquidate a digital assets position in a timely manner at a reasonable price. The volatility and unpredictability of the price of digital assets may lead to significant and immediate losses.

Options-Specific Risk Warning: Options trading involves significant risk and is not suitable for all investors. Options are complex derivatives that can result in the loss of the entire invested capital, and in some cases, losses may exceed the initial investment. The value of options is highly sensitive to the price of the underlying asset, volatility, time decay, and other market factors. Market conditions can change rapidly, and it may not be possible to exit an option position at a favourable price or within a desired timeframe. Investors should ensure that they fully understand the characteristics, obligations, and risks associated with options before engaging in any transactions.

Capital at Risk: An investment in any of the products mentioned herein involves significant risks, including loss of an investor’s entire capital investment. Alternative investment strategies are intended only for investors who understand and accept the risks associated with investments in such products and these products are not suitable for all investors. Investments in digital assets are high-risk investments and you should not expect to be protected if something goes wrong. The volatility and unpredictability of the price of digital assets may lead to significant and immediate losses. You are invited to do all the necessary research and learn before investing in digital assets. Nothing herein is intended to imply that the Laser’s investment methodology may be considered “conservative”, “safe”, “risk free”, or “risk averse.” The capital and/or return are not guaranteed, nor are they protected.

Simulated Performance: Simulated performance is hypothetical and may not take into account material economic and market factors that would impact the investment manager’s decision-making. Simulated results are achieved by retroactively applying a model with the benefit of hindsight. The results reflect the reinvestment of dividends and other earnings, but do not reflect fees, transaction costs, and other expenses, which would reduce returns. Actual results will vary, and these results are not a reliable indicator of future performance.

Past Performance: In considering any performance data in this Presentation, you should bear in mind that past or targeted performance is not indicative of future results, and there can be no assurance that any of the assets/products mentioned here would achieve comparable results or that target returns would be met. Past performance is not a guide to future performance, future returns are not guarantees and a loss of original capital may occur. The price and value of investments referred to in this document may fluctuate . This information is provided for illustrative purposes only and is not an indication of the future performance of any asset referred to herein. All investments must be made on the basis of the applicable legal documentation only. Current performance may be lower or higher than the performance data quoted. Where not relevant or representative, outliers may be excluded. Any future performance is subject to taxation which depends on the personal situation of each investor and which may change in the future. Changes to exchange rates could have adverse effects on the value or price of, or income derived from, certain investments in any of the assets referred to herein.

Non-Independent Research: This material does not qualify as independent financial research. It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. Research reports do not constitute a personalized investment recommendation as defined under the applicable laws and regulations, are not addressed to a specific client, and are prepared without analyzing the financial circumstances, investment profiles or risk profiles of clients. Laser Digital assumes no responsibility for any investment decisions that may be taken by a client or any other person based on this research report.

Forecast: Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. Whether forecasts are made, these forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. None party of the Laser Group has any obligation to provide updates or changes to these forecasts. Case studies and examples are for illustrative purposes only.

Forward Looking Statements: Certain information contained herein constitutes forward-looking statements, which can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “anticipate”,“project”, “estimate”, “intend”, “continue” or “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Laser Digital or the actual performance of any product referred to herein may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward-looking statements in making their investment decisions. The key facts and service providers referenced here are subject to change. Some statements reflect Laser Digital’s views, estimates, opinions, or predictions based on proprietary models and assumptions, particularly concerning the digital asset market. There is no guarantee that these views, estimates, opinions, or predictions are accurate or will be realized. If these assumptions or models are incorrect or circumstances change, the assets actual performance may differ significantly and be lower than the estimated performance. Any updates to fundamental research perspectives (including projections, price targets, or significant revisions to growth estimates) will not lead to a change to this Presentation. This material has been prepared by Laser Digital research desk. Certain views and opinions expressed may differ from those of Laser Group and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities and/or digital assets.

Conflict of interest: Laser Digital companies may occasionally act as principal traders, brokers, dealer or asset managers in the digital assets mentioned on this presentation and may hold these (and other) digital assets as well as financial instruments linked to such digital assets. Laser Digital has in place several conflict of interest management arrangements, including a conflict of interest policy, personal account dealing policy as well as information barriers and Chinese Walls arrangements. Our salespeople, traders, and other professionals might share market commentary or trading strategies, either orally or in writing, with our clients and principal trading desks that could present opinions differing from those found in this research. The asset management division, principal trading desks, and investment operations may make investment choices that are not consistent with the analyses or perspectives provided in this research. Our organization, including our affiliates, officers, directors, and employees, may periodically hold long or short positions, act as principals, and trade in the securities or derivatives discussed in this research, unless restricted by regulation or internal policies.

UK: This document is being issued in the United Kingdom by Laser Digital UK Ltd, 1 Angel Lane, London EC4R 3AB, United Kingdom, to and/or is directed only at persons who are professional investors and this document must not be relied or acted upon by any other persons in the United Kingdom. Laser Digital UK Ltd, FRN 1000108, is an appointed representative of Strata Global Ltd, which is authorised and regulated by the Financial Conduct Authority, FRN 563834. Strata Global Ltd is registered in England & Wales with company number 07707508 and whose registered office is at 7-11 Moorgate, London EC2R 6AF. All, or most, of the rules made under the FSMA for the protection of retail clients will not apply, and compensation under the United Kingdom Financial Services Compensation Scheme will not be available.

UAE (excluding ADGM and DIFC): In the UAE (excluding ADGM and DIFC), this document is issued by Laser Digital Middle East FZE (“LDME”). LDME is the investment manager of the fund and is authorised and regulated by the Dubai Virtual Assets Regulatory Authority (“VARA”) with registered number VL/23/06/001. We are registered in Dubai, and only deal with or for Qualified Investors and Institutional Investors as defined by VARA. Our registered office is located at Office 904, Level 09, One Za’beel Tower A, DWTC, Dubai, UAE. Additional information on LDME and the relevant regulatory disclosures may be found at https://www.laserdigital.com/laser-digital-middle-east. The information contained herein, does not constitute, and is not intended to constitute, a public offer of securities in the United Arab Emirates (“UAE”) and accordingly should not be construed as such.

UAE (ADGM): In ADGM, this document is issued by Laser Digital (AD) Ltd (“LDAD”), with registered office at Suite 206, Foor 14, Sarab Tower, Abu Dhabi Global Market Square, Abu Dhabi, Al Maryah Island, UAE. LDAD is authorised by the Financial Services Regulatory Authority (FSRA), holding a financial services permission with number 240029. The scope of Regulated Activities and relevant restrictions are set out here. In accordance with section 30(4)(a) of FSMR, the following limitations and stipulations apply to all Regulated Activities, unless specified otherwise: Laser Digital (AD) Limited is not permitted to deal with Retail Clients as defined under the Conduct of Business Rulebook (COBS). This document is intended for distribution only to Professional Investors and/or Market Counterparties. It must not be delivered to, relied on by or acted upon by, any other person. The FSRA does not accept any responsibility for the content of the information included in this document, including the accuracy or completeness of such information. The FSRA has also not assessed the suitability of the products or services to which this document relates to any investor or type of investor. If you do not understand the contents of this document or are unsure whether the products or services to which this document relates are suitable for your individual investment objectives and circumstances, you should consult an authorised financial adviser.

Restricted jurisdictions: The distribution of this document and the offering of any product mentioned herein may be restricted in certain jurisdictions. The information below is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of and observe all applicable laws and regulations of any relevant jurisdiction. Such persons should also inform themselves of any applicable legal requirements, exchange control regulations and taxes in the countries of their respective citizenship, residence or domicile. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation. In particular, this document does not constitute an offer of securities to sell or a solicitation of an offer to purchase in or into the United States, Canada, Australia.